How to Manage Your Cash Flow: 3 Simple Tips to Help You Pay Down Debt and Stop Overspending

By Ross Marshall. Posted: January 2021

Your cash flow is key to managing your assets and crucial to building a solid, personal financial plan. Read this article to learn how you can calculate your cash flow as well as three simple budgeting techniques that’ll help you manage it better!

In this article:

- What does cash flow management actually mean?

- Where are cash flows used?

- Sample monthly cash flow calculation

- In what way does managing my cash flow help me personally?

- How do I start managing my cash flow?

- 3 Cash flow budgeting tips to help you get started

What does cash flow management actually mean?

Cash flow refers to the money that moves in and out of your business or personal finances. See how we emphasized in and out? That’s because cash, from a personal or business standpoint, doesn’t just move one way. In fact, it can flow both ways. Take, for example your personal finances:

- Money moving into your personal finances could be the income you get from your 9 to 5 job, interest from your savings account, or the annual $50 your grandmother sends you with your birthday card.

- Money moving out of your personal finances include your expenses, including your groceries, petrol, leisure activities, loan repayments, and so on.

There are two different types of cash flow, namely, a positive cashflow and negative cashflow. A positive cashflow means you have more money coming in than you’re spending. In contrast, a negative cash flow is the exact opposite, where you’re paying out more than you’re receiving.

Since your cash flow is calculated as a net amount (i.e., your income minus your expenses), you can consider it as your ready supply of money to fund any of your ventures, whether it be for business or pleasure.

Why is knowing your personal cash flow important?

Consistently having a positive cash flow gives you more opportunities to save, invest, or even pay debts. But you may not even know if you have a positive or negative cash flow! Only by tallying up your income and expenses can you get an accurate picture on your financial health.

Here are 3 benefits of analysing your personal cash flow:

Cash flow analysis “shows you the money”

Understanding your personal cash flow helps you track where your money comes from and where you’re spending it. This is the first important step in creating financial awareness.

Cash flow analysis can help you “cut the fat”

Looking at your personal cash flow forces you to take a hard look at your expenses and how it stacks up against your income. Wouldn’t it be great if you could save more of your income by cutting back on things you don’t really need?

Cash flow analyses guide your financial decisions

Staying on top of your cash flows helps you make better financial commitments. For example, knowing how much positive cash flow you really have helps you choose more affordable mortgage payments that keep you out of the red, or identify bad spending habits that could instead allow you to save for a holiday.

Where are cash flows used?

Cash flows can be used by both individuals and corporations alike. In general, cash flows are an excellent tool for knowing where your income is spent, and getting an accurate picture of how much money you have to “work with”. It’s painfully common for profitable companies to go bankrupt because of poor cash flow management – and individuals, sadly, are not different. You may have heard the expression “cash flow is king”, and it’s true – cash flow is like the fuel powering a large machine (the machine being either a company or your life); without fuel the machine will quickly shut down.

From a personal standpoint, cash flow is considered a fundamental property when your financial advisors assess your assets. As such, understanding your cash flow also helps you and your advisor craft your short- and long-term financial plans.

Meanwhile, businesses, big and small, use cash flows to understand their financial health. By maintaining up-to-date cash flow statements, business owners can spot sales trends and unnecessary expenses. This can better inform entrepreneurs to plan their yearly budgets, meet sales targets, reassess their operating costs, and cover mandatory payments.

Sample monthly cash flow calculation

For example, let’s say you have a full-time job that pays you $8,000 every month. You can label that as your income.

Now, let’s take a look at your expenses. You have a $2,000 monthly mortgage payment with a 6% interest fee. You also have to make $1,000 payments for a car loan at 3%. Lastly, your utility and personal expenses every month amounting to $2,000. That sums up to $5,000 monthly expenses. This scenario gives you a positive cash flow of $3,000 to use as you see fit.

Now let’s say you’ve successfully paid your mortgage. This will drastically decrease your expenses and increase your cash flow surplus up to $5,000.

Now, consider (knock on wood) a situation where you get laid off, and find a job that pays less at $6,000 per month instead. This brings down your positive cash flow surplus to $1,000. Notice how a smaller income decreases your cash flow? You might have to make major budget cuts to keep up with your expenses.

In what way does managing my cash flow help me personally?

The point of describing these scenarios is to show you that life changes affect your cash flow. Some changes can be planned, but you have to consider that other changes can come unexpectedly. This makes improving your cash flow immensely important. In doing so, dealing with future financial bumps won’t be as painful. The best way to keep your cash flow as high as possible is to cut down on your expenses, choose flexible payment strategies, and secure additional income streams.

Better cash flow strategies also keep you from incurring debt. Remember that car loan payment you make at 3% every month? This is an ongoing liability that contributes to your negative cash flow. Meanwhile, if you were to put off buying a car, save for it, and pay it in cash later, you’ll have a higher net income at the end of each month.

Overspending diminishes your cash flow! Managing your cash flow also helps you take a closer look at your expenses. You’ll be able to see exactly how much you spent on those impromptu coffee runs and shopping sprees.

How do I start managing my cash flow?

Follow these 3 steps to start tracking your cash flow:

Step 1: Tally Your Income and Expenses

The first step to managing your cash flow is to take a close, hard look at your income and expenses. You can do this digitally using expense tracking apps and spreadsheets – if you’re old school you can also use a pen and paper, though we take no responsibility for sore fingers/wrists!

We recommend basing your calculations on six months of income and expenses – this gives you a broader data set and makes the numbers more accurate by averaging them out over a longer time period; otherwise you risk skewing your figures by including that expensive lobster dinner you paid for at your anniversary, or an extra large bonus you got at work, etc.

TIP: Recalling six months-worth of expenses can be hard. To get around this, review your bank and credit card statements. As for your income, you can check your payslips or your online banking history (filter by “Credits” or “Money In”). Many online banking systems allow you to filter and export your transactional data in CSV format, this will be one of the simplest ways for you to separate, identify and compare your income and expenses.

Step 2: Group Your Incomes and Expenses

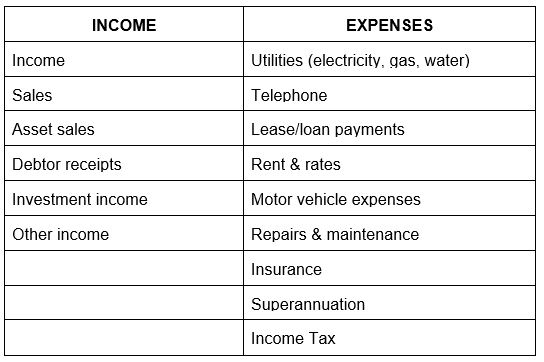

Take your list and group the entries according to different types of incomes and expenses. business.gov.au has a sample cash flow template that classifies incomes and expenses this way:

You can further segment your income and expenses list by month so you can get a better look at your finances, or just average out it over time to get a ballpark figure.

TIP: Your list of incomes and expenses doesn’t have to look exactly like this! We all lead different lives, so it’s expected that your cash flow statement is different from somebody else’s. What’s important is you identify every source of income and expenses and categorize them accordingly.

Step 3: Calculate Your Cash Flow

Total your income and subtract that with your total expenses. The number you’ll end up with is your cash flow for the past six months:

Cash Flow=Total Income-Total Expenses

You can now divide this down by month or even by week to see what your monthly or weekly cash flow amount is.

A good rule of thumb to say whether your cash flow is in good standing or not is if it’s a positive value. Having a positive cash flow means that you’re spending below what you earn, which is a good thing!

If your cash flow is small or nearing a negative value, you’ll want to do a “spring cleaning” of your expenses. By spring cleaning, we mean:

- See where your expenses are coming from, and

- Evaluate what you can cut back on

TIP: You might think that a few tiny expenses won’t make a difference. But if you add up all those tiny expenses, you’ll still end up with a number which is likely to make a notable difference to your life. Take a look at all those unnecessary expenses like magazine subscriptions, coffee runs, subscriptions you don’t use that much, and other things. No unnecessary expense is too small to simply live with!

RELATED READING: Budget Planning: 5 Awesome Wins for An Earlier Retirement

3 Cash flow budgeting tips to help you get started

1. Set Weekly Allowances

Traditional budgeting methods are based on your monthly expenses. But even with a carefully planned monthly budget, it’s easy to go off track – we probably all know someone who “saves a lot of money during the pandemic” but orders a ton of takeaway food, online subscriptions and Amazon/eBay/online shopping orders!

It’s easy to set up your weekly allowance. Here’s a quick example:

- $8,000 monthly income

- $5,000 total monthly expenses (including your savings!)

This leaves you with a $3,000 cash flow surplus. With this, your weekly allowance is $750 ($3,000 divided by four weeks) that you’re allowed to spend on whatever your heart desires, known as discretionary spending.

According to behavioural economist Jeff Kreisler on Forbes, weekly allowances are easier to sustain because “cutting down discretionary spending into smaller amounts forces individuals to make more specific decisions. In doing so, spending decisions are not only easier, but are less consequential to an overall budget.” This helps you be more aware of your expenses as compared to mindlessly swiping your credit card or spending your cash flow until you meet your monthly limit (sometimes after only a week or two!).

2. Start Bucket Budgeting

Want a simpler way of managing your cashflow without the apps or spreadsheets? Give the bucket budgeting method a try. There are plenty of other techniques out there, but no matter how clever the concept it always comes back to the same thing – can you follow it? What makes bucket budgeting effective is that it’s simple, which makes it easy to follow.

With this budgeting method, you’ll group your expenses into four buckets (the easiest implementation is to set up a dedicated account for each one):

- Bills bucket (30%): utilities, mortgages, loans

- Every Day bucket (30%): groceries, transportation

- Spending bucket (20%): leisure activities

- Savings bucket (20%): goals like a new car, property, or annual trip

With every payment cut-off, you can allocate percentages of your income to fill these buckets. You can (and should!) automate these payments using direct debit, so you can never cheat and skip filling your buckets. Then, each time you need to spend on something, all you need to do is draw from the bucket! This ensures your individual bucket-budgets are kept under control and you don’t end up skipping on your savings by spending too much on groceries or leisure.

3. Opt for Cash-Basis Budgeting

Nowadays, it’s becoming more convenient to pay with your credit card. Credit card companies are upping the ante by offering irresistible rewards that encourage you to spend. Thing is, if you’re not careful, you could overspend your budget with a single swipe – and the interest you’ll get charged is a cash flow killer.

To get around this, opt for cash-based spending instead. Paying in cash actualises your expenses, which makes you more aware of how much you’re spending. In behavioural economics this is called the “pain of paying.” With credit cards, your expenses are delayed – and invisible if you don’t check your statements! But when you pay in cash, you feel the weight of your expense right away; you can your wallet slowly emptying. It’s this feeling of immediate guilt that keeps you from overspending.

You can even combine this cash-based and bucket-budget approaches. We’ve met some people who have separate wallets for different expenses, or who walk around with labelled envelopes (one memorable example was a trio of envelopes labelled “Food”, “Fuel” and “Fun”) to ensure correct expense allocation. At the end of the week, refill your envelopes up to your set amount and take whatever change was left to pay off some extra debt, or put into your savings.

Note: this cash-based method isn’t as effective as it used to be, with some venues and businesses transacting only with card-based payments during the pandemic. If this is the case in your area, a bucket-based method with an everyday expenses debit card/s will probably be more appropriate.

Key Takeaways

Managing your cash flow is the first step to securing your financial future. The earlier you get a hold of it, the easier achieving your financial goals will be. Talking to an experienced financial advisor for the best cash flow strategies is the best way to secure a worry-free financial future.

At Raeburn Advisors, we believe that everyone deserves a financially secure future. Our services are focused on providing easy-to-understand financial advice with clear, actionable insights to help you better manage your cash flow, curb overspending, and eliminate debt.

Reach out to us today and let’s talk about your financial goals.

Enjoying the content? Follow us on Facebook, Instagram, or LinkedIn, and subscribe to our monthly newsletter to make sure you stay up to date.

Disclaimer:

This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.