Everything You Need to Know About the Upcoming Consumer Credit Reforms

By Ross Marshall. Posted: February 2021

In September 2020, the Australian Government announced that it’ll make reforms to the decade-old National Consumer Credit Protection Act. What are these changes and how will they affect your ability to access credit during the COVID-19 pandemic? Read now to learn!

In this article:

- What is the main purpose of the National Consumer Credit Protection Act?

- What does the National Consumer Credit Protection Act 2009 cover?

- How does the Consumer Credit Act protect me as a customer?

- Why is the Government revising the Credit Act?

- What primary change can I expect from this Credit Act reform?

- How will the revised Credit Act help me?

- Are there downsides to the proposed changes in the Credit Act?

- When will these reforms be implemented?

What is the main purpose of the National Consumer Credit Protection Act?

As its name suggests, the National Consumer Credit Protection Act of 2009 (NCCP), also known as the Credit Act, is an Australian law that helps protect consumer credit. It holds power over credit providers and ensures responsible credit lending. The Australian Securities & Investment Commission (ASIC) enforces the NCCP and guided by the National Consumer Credit Protection Regulations of 2010.

The NCCP requires credit providers to have a license or authorisation to give out loans. The act also outlines a list of responsible lending obligations (RLO) credit providers use to objectively determine whether a person qualifies for a credit product or credit limit increase.

What does the National Consumer Credit Protection Act 2009 cover?

The Credit Act applies to most personal, household, or domestic banking and credit products. Consumer credit products that are covered by the NCCP include:

- Car loans

- Personal loans

- Home loans

- Credit cards

- Consumer leases

Apart from covering everyday banking products, the NCCP also outlines consumer credit safeguards. The act describes the rules that govern lenders’ licensing, credit suitability, and credit lending conduct.

How does the Consumer Credit Act protect me as a customer?

As a consumer, the National Consumer Credit Protection Act of 2009 provides protections for everyday Australians like you who want to borrow consumer credit.

For one, the NCCP requires credit providers to give borrowers updated periodic statements of account. Receiving regular statements promote transparency that you’re being billed correctly. Statements also help you keep track of your dues, ensuring that you stay on top of your expenses.

The Credit Act also stipulates interest rate caps that credit providers charge their borrowers. Specifically for Small Amount Credit Loans (SACC), the NCCP allows a longer payment duration for loans under a contract worth less than $2,000—16 days but no longer than one year. This means you can spread out your expenses and have more cash flow to work into your budget.

Lastly, the Act also gives you the means to holds credit providers liable for damages or seek penalties should they violate any of the NCCP’s laws.

Why is the Government revising the Credit Act?

Access to consumer credit has always been the fuel for economic growth and the lifeblood for many Australians’ dreams. Many Australians apply for consumer credit to buy a family home and drive their dream car. Budding entrepreneurs often take on loans to start their own business, which stimulates the economy and creates jobs.

Since the surge of the COVID-19 pandemic, many have struggled to fulfill their pending financial obligations and recover from their losses. That’s why now more than ever, it is important that the system for accessing consumer credit should be speedy and unhampered to help Australians as well as all local businesses to recover post-pandemic.

What primary change can I expect from this Credit Act reform?

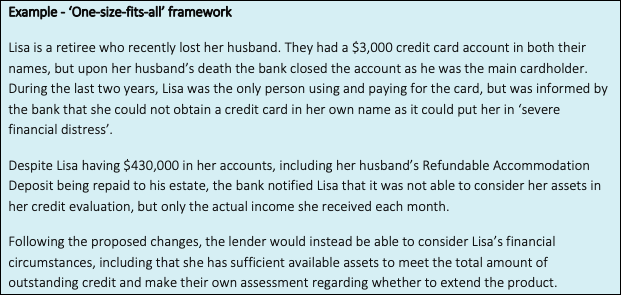

The current Credit Act uses a one-size-fits-all policy that outlines how credit providers assess and grant (or deny) borrowers a credit product. Here’s an example of how this policy works out:

As it stands, the one-size-fits-all policy has been described as burdensome as it puts both lenders and borrowers through unnecessary processes that end up lengthening procedures and delaying credit access. This can affect your ability to secure a home or keep your business afloat especially with the COVID-19 pandemic continuing on.

As such, the Australian Government aims to move away from the one-size-fits-all model, simplify the credit borrowing process, and strengthen consumer and lender protections.

According to a 25 September 2020 release by Minister for Housing and Assistant Treasurer Honorable Michael Sukkar MP, specific consumer credit reforms include:

- Removing responsible lending obligations from the National Consumer Credit Protection Act 2009, with the exception of small amount credit contracts (SACCs) and consumer leases where heightened obligations will be introduced.

- Ensuring that authorised deposit-taking institutions (ADIs) will continue to comply with APRA’s lending standards requiring sound credit assessment and approval criteria.

- Adopting key elements of APRA’s ADI lending standards and applying them to non-ADIs.

- Protecting consumers from the predatory practices of debt management firms by requiring them to hold an Australian Credit Licence when they are paid to represent consumers in disputes with financial institutions.

- Allowing lenders to rely on the information provided by borrowers, replacing the current practice of ‘lender beware’ with a ‘borrower responsibility’ principle.

- Removing the ambiguity regarding the application of consumer lending laws to small business lending.

How will the revised Credit Act help me?

1. It’s easier to borrow

Should these consumer credit reforms push through, you as a borrower can definitely benefit, especially if your finances took a hit as a result of the COVI-19 pandemic. The point of making these reforms is to relax the current lending laws without giving lenders too much power to “get one over you”.

The process for taking out a mortgage or personal loan or applying for a credit card will be shorter, should these reforms push through. It’s also likely be easier to apply for these loans given that lenders will scrutinise your application less than they usually would.

2. Assets may increase in value

Historically, an increase in money supply leads to reduced interest rates and a rise in inflation. This in turn stimulates investment and also drives up the price of assets. If you’re considering investing, you may be better off doing it sooner rather than later to benefit from market shifts.

Simply put, the proposed consumer credit reforms will help by:

- Ensuring high-cost forms of credit borrowing are protected, and

- Protecting consumers from predatory practices of debt management firms.

- Potentially increasing the value of assets, due greater money supply and inflation

Are there downsides to the proposed changes in the Credit Act?

While these reforms will make taking out a mortgage easy, they won’t make paying loans any easier. At the end of the day, you’re still responsible for paying your dues. And these dues can blow up quickly when you continuously borrow credit.

NOTE: When it comes to taking out credit, it’s best to exercise caution. Incurring debt can have long-term adverse impacts on your finances.

Critics also suggest that making lending easy during a recession that’s prompted by the pandemic increases the “buyer beware” mentality that the original NCCP got rid of years ago, by placing the onus on borrowers to do their due diligence. Some analysts are also concerned that the removal of ASIC enforcing the NCCP (with the APRA standing in to ‘supervise’ lending standards are met) could have the opposite of the desired effect by giving too much power back to lenders.

When will these reforms be implemented?

Based on the most recent consumer credit reforms fact sheet, changes to the NCCP will be implemented by 1 April 2021.

Make better financial decisions with Raeburn Advisors

These consumer credit reforms sound overwhelming, and you might be initially unsure if you’ll benefit or not. As experts in finance, we at Raeburn Advisors can walk you through these changes before they take effect in April. Securing financial advice, especially during the pandemic, will make fulfilling financial obligations less arduous.

Contact us today to find out how you can not only financially recover during the COVID-19 pandemic, but thrive.

Enjoying the content? Follow us on Facebook, Instagram, or LinkedIn, and subscribe to our monthly newsletter to make sure you stay up to date.

Disclaimer: This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.